The editor’s opinion from Marketplace, Northeast Wisconsin’s business magazine. (Obligatory disclaimer: Most hyperlinks go to outside sites, and we’re not responsible for their content. And like fresh watermelon, peaches, pineapple, grapefruit, tomatoes and sweet corn, hyperlinks can go bad after a while.)

July 31, 2008

Is something brewing at Fox Cities Stadium?

The timing of this is interesting because, while the Rattlers’ contract with the Mariners expires after this season. the Milwaukee Brewers’ contract with their similar Class A affiliate, the West Virginia Power, also expires after this season.

The Brewers haven’t had a minor league affiliate in Wisconsin since 2004, when they severed relations with the Beloit Snappers. The Timber Rattlers have been affiliated with the Mariners since 1993, when they were known as the Appleton Foxes. Many major league teams have been affiliated with Appleton-area minor league teams. The 1940–53 Appleton Papermakers were linked with the Cleveland Indians, Philadelphia Phillies, St. Louis Browns (who became the Baltimore Orioles) and Milwaukee Braves. The Foxes, formed in 1958, affiliated with the Washington Senators (who became the Minnesota Twins), Chicago White Sox (for 26 years) and the Kansas City Royals before the Mariners.

A Brewers–Timber Rattlers agreement would be an ideal move for both the Timber Rattlers and the Brewers. The Brewers’ franchise is clearly on the upswing, having finally reached .500 in 2005 and finishing with a winning record in 2007, following 25 years that were analogous to the Packers’ “Gory Years,” with wins and playoff berths few and far between. The Brewers have gotten several awards for the quality of their minor league system this decade, and their home-grown players include first baseman Prince Fielder, second baseman Rickie Weeks, shortstop J.J. Hardy, third baseman Bill Hall, left fielder Ryan Braun, right fielder Corey Hart and starting pitchers Ben Sheets and Manny Parra. The Power, the Brewers’ minor league team at the same level as the Rattlers, is (are?) in first place in the Northern Division of the South Atlantic League.

The Timber Rattlers’ relationship with the Mariners has served the Rattlers well until recently. (I remember watching Alex Rodriguez have a poor night for the Foxes in Goodland Field’s and the Foxes’ final season in 1994. That was the season where Rodriguez did something probably unprecedented — he played in Class A and Class AA, then the Mariners, then was sent down to the Mariners’ Class AAA affiliate just before the 1994 players’ strike, all in the same season.) As of today, Wisconsin is 42–63, 11–28 in the second half of this season. The Rattlers played in the Midwest League championship series in 2005, but have not contended for a playoff berth since then, finishing 54–86 in 2006 and 53–85 in 2007.

That, of course, reflects the quality of players sent to the Timber Rattlers by the Mariners. One ranking placed the Brewers’ minor league system as fifth best in baseball, while the Mariners’ system ranked 19th. Minor League Baseball.com noted in 2007 that the Mariners’ drafts of North American players had produced “only a handful of major leaguers dating back to 2000.” Not surprisingly, the Mariners have gone downhill since they set the record for wins in a regular season with 116 in 2001, their last playoff season. The Mariners are on their second general manager and field manager of this season.

Of course, minor league baseball isn’t specifically about winning. An impressive list of major leaguers has played for Appleton or Wisconsin, including new Hall of Fame relief pitcher Rich “Goose” Gossage, Cy Young-winning starting pitchers Pete Vuckovich and LaMarr Hoyt, former Rookie of the Year Ron Kittle, Mariners starting pitcher Felix Hernandez (who is good enough to have his own bobblehead), Boston Red Sox designated hitter David Ortiz, and, of course, the player now known as “A-Rod.” Hall of Fame manager Earl Weaver, who managed the Orioles into four World Series, won the 1960 Midwest League title managing the Foxes, as did former Florida Marlins manager John Boles in 1983.

The 2007 Timber Rattlers drew 197,511 fans, 3,237 per game, eighth best in the Midwest League, and, more importantly, 59 percent of capacity. So far this season, the Rattlers are averaging about 2,500 fans per game, about 45 percent of capacity, though the franchise was hampered by our crappy spring.

Affiliating with the Brewers could result in an upswing in attendance from Brewers’ fans, on Brewers’ days off or on road trips, for those interested in seeing future Brewers, or for those looking for a less expensive Brewers baseball experience. Having a minor league affiliate two hours away would be quite handy for Brewers’ player personnel executives, too. (The Brewers’ three higher-level affiliates are in central Florida, Huntsville, Ala., and Nashville.) Next year’s Timber Rattlers could have players from the Brewers’ two rookie league teams, the Arizona Brewers and the Helena (Mont.) Brewers, plus leftovers from this year’s Power.

That also might result in some more media attention for the Timber Rattlers, whose games are broadcast on a Clintonville radio station and online and who get a “Rattler Report,” instead of a game story, in the Post~Crescent. (Perhaps Fox Sports Wisconsin might see fit to start covering Timber Rattler games; a few games are on Time Warner Cable now, but if you’re not a Time Warner subscriber, you can’t watch them.) Conversely, having an in-state minor league affiliate could help the Brewers’ statewide marketing efforts, which are in a catchup mode after having had no appreciable statewide marketing efforts before the Brewers’ current ownership took over.

The date to watch is Sept. 16, when major league teams can begin negotiating with minor league teams through Sept. 30. As Rattlers president Rob Zerjav told the Post~Crescent, “I think whenever we make a decision, it’s important that we look at what the fans want. They’re the ones buying the tickets. You want to give them what they want. So it’s one aspect of how we make the decision.”

“If the Brewers are looking at Appleton, I'd understand,” Andy Milovich, executive vice president of Palisades Baseball, the management company that runs the Power, told the Charleston (W.Va.) Gazette. “I don’t think the stadium there is as good as ours [an assertion unsupported by the online evidence — for one thing, Time Warner Cable Field at Fox Cities Stadium holds 1,000 more than Appalachian Power Park], but I’m sure there’s pressure from the local media and politicians to move [the Brewers] there.” (Pressure? Moi?)

From an outside perspective, there seem to be no negatives with a Brewers–Timber Rattlers affiliation deal. Let’s hope it happens.

July 30, 2008

Your tax dollars at work

Perhaps the NTEU is referring to the negative stereotype of government employees being overpaid? The Cato Institute determined that federal employees were paid, on average, $100,178 in wages and benefits in 2004, vs. $51,876 for private-sector workers. The NTU also notes that one in 5,000 nondefense federal employees is fired for poor performance each year.

As the NTU puts it, the campaign "doesn’t reflect the reality that federal workers are paid extremely well to do the jobs they almost can’t lose. ... Since we pay them via taxes, they should get back to work and do their jobs efficiently, excellently, and with gratitude to the American taxpayer."

Analysis of the Day

What if I told you that a prominent global political figure in recent months has proposed: abrogating key features of his government's contracts with energy companies; unilaterally renegotiating his country's international economic treaties; dramatically raising marginal tax rates on the "rich" to levels not seen in his country in three decades (which would make them among the highest in the world); and changing his country's social insurance system into explicit welfare by severing the link between taxes and benefits?For one thing, "I" would be Stanford University Economics Prof. Michael J. Boskin writing in Tuesday's Wall Street Journal about Barack Obama's startling economic ignorance. For one thing, Obama's plans to increase taxes would result in, according to Boskin, a drop in after-tax return per dollar of earnings by 32.9 percent, and a drop in after-tax return per dollar of dividends by 30.6 percent.

As Boskin puts it: "History teaches us that high taxes and protectionism are not conducive to a thriving economy, the extreme case being the higher taxes and tariffs that deepened the Great Depression. While such a policy mix would be a real change, as philosophers remind us, change is not always progress."

July 29, 2008

Misery loves company

More than half the states are experiencing budget deficits, including, as we all know, Wisconsin. All but two Midwestern states, Indiana and Missouri, has a gap between revenues and expenditures. Three states, Illinois, Iowa and Minnesota, have budget gaps of 8 percent or more. Interestingly, all but one of those deficit-plagued states, Minnesota, has a Democratic governor, while Indiana's and Missouri's governors are Republicans. (Before you condemn this as a partisan slam, read on.)

Minnesota's governor is Republican Tim Pawlenty, who you may have read is apparently on John McCain's vice presidential short list (perhaps a list of one, in fact). This may not make conservatives happy, because Pawlenty's fiscal record as governor apparently leaves a lot to be desired — the National Taxpayers Union says his tax record "can rightly be described as a disaster for Minnesotans," complete with $1.74 billion in tax increases. Others, however, argue that Pawlenty "has reshaped Minnesota with fiscal restraint and the most taxpayer-friendly administration in the history of Minnesota," and that Pawlenty should not be blamed for vetoes that were overridden by "hostile liberal majorities."

The NCSL reports that few states (but not all, as we discovered Monday) are trying to close their budget gaps by "cutting spending and tapping reserves." This is laudable, if true. It would have been better, of course, for those states to have not increased spending that now needs cutting in the first place. Then again, the NCSL appears to like tax increases, given that they think that either federal gas tax needs an increase or a vehicle-miles-based tax needs to be enacted in an era of $4-per-gallon gas.

Wisconsin's current fiscal woes date back to the 1990s, when Republican Gov. Tommy Thompson decided that a booming economy meant the state could increase spending and cut some taxes. Thompson was clearly preferable to any of his opponents, but taxes and spending were and are too high in this state, and current experience demonstrates that just because you can afford high levels of government spending at a particular time doesn't mean you'll always be able to afford it. But most voters in Wisconsin apparently don't care about either taxes or spending, or they may say they care, but they don't vote like they care.

July 28, 2008

Analyses of the Day

(1) Columnist Kimberly A. Strassel's Potomac Watch column reporting that congressional Democrats are threatening business groups with blatantly anti-business legislation in the next congressional session unless the business groups give them campaign contributions. (In the non-political world, this is called "extortion.") And it's not as if Democrats are being subtle about it:

[Senate Majority Leader Harry] Reid stepped up the pressure with last week's pow-wow. Democrats invited only presidents and CEOs of the most powerful trade groups, hoping to circumvent GOP lobbyists and take their message straight to the top. That message? According to one participant, the meeting was cordial, but the theme clear: "We have a narrow margin right now, and it is tough for us to get anything done. But there will be more of us next year, you'd better get used to it, and you better find a way to work with us."...Based on this, anyone who tells you that Democrats are pro-business is lying. Eighth Congressional District residents should ask their congressman, who is running for reelection, about this. (And, by the way, what are his views on business anyway?)

(2) Columnist David Ranson of H.C. Wainwright Economics on people's view of the economy, as opposed to what the economy is actually like:

People tend to anthropomorphize the world around them, and not just in economics. We look at the outside world and assume that it is governed in the same way as our own lives. For example, we're mystified by Mother Nature's apparent heartlessness and large-scale disregard for what we cherish: order, justice and the sanctity of life. We still resist the notion that we can't dictate the course of the Mississippi, control the way the planet evolves, or equalize the distribution of income.The same parochial streak in human nature is rife in economic commentary. In the context of a household or a business, debt is a burden and can become a threat. But for society as a whole, debt finance is a prime means of capitalizing production and growth.

It's extraordinary, then, that in national debate the narrow view drowns out the broad. Aggregate private debt and trade deficits are widely regarded with equal suspicion and fear — even by "experts." Instead of celebrating the role that private debt has played in creating prosperity, many blame "excessive" debt when things go wrong, and cite it as a basis for pessimism. ...

There's an old saying that if your neighbors are losing their jobs it's a recession; if you are losing yours it's a depression. It's therefore unfortunate that such a large fraction of prominent forecasters hails from the financial community. Their views are colored by the turmoil suffered in their industry. ...

We are not a nation of whiners, but we do have a lot of alarmists. It is becoming politically incorrect to suggest that the economy is basically sound.

Ranson borrows a metaphor from Franklin Roosevelt's first inaugural address: "What's excessive now is fear, not debt: Fears of insolvency and private-sector indebtedness are misplaced and harmful. They place obstacles in the way of ill-used capital that seeks to move toward safer and more profitable employment. They plunge the stock market into turbulence. They push government into hasty actions that intrude more aggressively into private choices and decisions. They undercut the market-price system, without which the economy cannot allocate resources productively. Last but not least, these fears trigger the proverbial false alarm in a crowded theater, sending everyone stampeding for the exits."

“Reform” and reform

That’s not the case with our neighbors to the north, Michigan. On Election Day Michigan voters will decide (assuming the referendum isn't thrown off the ballot in the court system) the fate of a constitutional referendum that would reduce the number, salaries and benefits of elected officials, legislators and judges, reconfigure the state’s judicial system, and change election law.

On the face of the proposal, this incredibly lengthy proposal includes many seemingly worthy initiatives. The Michigan Senate would lose 10 of its 38 senators, and the Michigan House would lose 28 of its 110 representatives. Two Supreme Court justice positions and seven Court of Appeals positions would be eliminated. Pay for Michigan’s governor, lieutenant governor, attorney general and secretary of state would be cut 25 percent, judicial pay would be cut by 15 percent, and pay for legislators would be cut by the 38 percent they voted for themselves in 2002. Elected officials would have to disclose their income and assets annually. The benefits of all elected officials would be reduced to the same that Michigan state employees get (which evidently are not as luxurious as the benefits of Wisconsin state employees). Elected officials would be banned from lobbying for two years. Redistricting of legislative districts would be taken out of the legislature’s hands to an independent commission.

This seems to be working with Michigan voters, 70 percent of whom favor the proposal, including 73 percent of Republican voters and 67 percent of Democratic voters, according to its sponsor, Reform Michigan Government Now.

Michigan voters clearly want something done because their state is, well, the Edsel (for younger readers: replace "Edsel" with "Yugo") of state economies. Michigan has lost 300,000 manufacturing jobs since 1999. Michigan was the only state to lose net jobs during 2007. The state's June unemployment rate was 8.5 percent (Wisconsin's was 4.9 percent), and a forecast earlier this year that Michigan's unemployment rate would hit 8.9 percent in 2009 now looks optimistic. Michigan also has one of the worst housing markets in the U.S., with, as of earlier this year, one out of every 20 mortgages either in or near foreclosure.

In such an environment, consider this: If you think Wisconsin elected officials are overpaid, consider that Michigan’s governor makes 30 percent more than Wisconsin’s, Michigan’s lieutenant governor makes 72 percent more than Wisconsin’s, Michigan legislators (who are full-time, and there are 16 more of them) make 68 percent more than Wisconsin’s (who are considered 60-percent full-time-equivalent), and Michigan’s Supreme Court makes 20 percent more than Wisconsin’s.

There is, however, a complication worthy of a potboiler novel. An intern for the Mackinac Center for Public Policy, a free-market think tank, discovered, on a United Auto Workers union Web site, a PowerPoint presentation, “Governmental Reform Proposal: Changing the rules of politics in Michigan to help Democrats.”

(I think this intern has just assured himself lifetime political employment.) Reading the first few slides shows that the authors of the PowerPoint basically believe Michigan’s system is broken because it didn’t produce the results the authors wanted, and is likely to produce results the authors do not want: “Labor and tort ‘reform,’ erosion of civil rights and environmental protections, budget cuts, [and] privatization.”

(I think this intern has just assured himself lifetime political employment.) Reading the first few slides shows that the authors of the PowerPoint basically believe Michigan’s system is broken because it didn’t produce the results the authors wanted, and is likely to produce results the authors do not want: “Labor and tort ‘reform,’ erosion of civil rights and environmental protections, budget cuts, [and] privatization.”The PowerPoint punchline is on page 11: “In 2008, use the public’s very negative mood and high level of discouragement about state government (the worst in 25 years) to enact a ballot proposal which comprehensively reforms state government, including changing the structural obstacles to Democratic control of state government in 2012–2021.” What follows is almost exactly the Reform Michigan Government Now proposal.

This part is unintentionally amusing: The estimated $4.911 million of the campaign is estimated at “less than half the cost of trying to beat an incumbent GOP Supreme Court Justice,” more than what is “spent every four years trying to win the House and Senate, usually unsuccessfully,” and less than half of the cost of a presidential-election-year “coordinated campaign.” If Michigan voters pass this, “it will reduce the cost and increase the prospects of winning the State Legislature every cycle.”

The point about the Supreme Court bears noting. Michigan's Supreme Court ranked dead last in a University of Chicago Law School study, based on "judicial independence from political or outside influences, its numbers of published opinions, and how often the court's decisions are referenced in rulings by other courts." The Public News Service noted that Michigan's Supreme Court "seems to be especially supportive of businesses, based on how it has split on many business-related decisions." (Wisconsin's Supreme Court ranked eighth in the University of Chicago study, and 24th in a U.S. Chamber of Commerce study, where Michigan ranked 33rd.)

Not surprisingly, the Mackinac Center opposes the proposal, having discerned that the PowerPoint "leaves little doubt that the Reform Michigan Government Now ballot initiative is a partisan power play. The most important features of the scheme are the redistricting commission and the removal of two Republicans from the Michigan Supreme Court. Nearly everything else in the proposal seems to be calculated to make the entire package more attractive to voters. ... While we have no objections to partisan politics as such, it is essential to call attention to partisan ploys that are presented as neutral good-government reforms."

The proposal's motives become more transparent when one notices that the proposal to reduce the size of Michigan's top two court levels is designed to weed out Republican judges. Then again, suddenly Michigan liberals have some hesitation about the proposal, one of whom is concerned that controversy over the proposal might actually affect the presidential race, as well as, interestingly, Michigan's Washington Democrats. Also noteworthy is that the PowerPoint author(s) mention the unpopularity of Michigan's Democratic governor, Jennifer Granholm, particularly after she got a tax increase passed one year ago, and yet also mention the lack of obvious Democratic successors for Granholm.

The final irony: Legal challenges have been raised to the vote (there is apparently a reference to a nonexistent part of Michigan's Constitution), which places Michigan’s judges in the strange position of having to decide whether a referendum that would reduce their own numbers and salaries is legal.

There is a more central issue here. It came to me when I was watching "All the King's Men," the Academy Award-winning 1949 movie based on the Pulitzer Prize-winning Robert Penn Warren novel about a Huey Long-like politician whose interest in reform metastasizes into an interest in driving the state's political machine. Reform is never successful if reform is centered around "who," as in whom to replace. Newt Gingrich engineered the Contract with America, which gave Democrats their worst congressional defeats in 50 years. Republican control of Congress lasted just 12 years, due in large part to Republicans' emulating most of the worst abuses of Democrats during their half-century controlling Congress.

Some would argue that voters shouldn't decide to reduce their representation. I don't buy that, particularly if the voters feel they're not being represented by their elected officials. (A friend of mine who has worked extensively in politics thinks Wisconsin should go to a one-house legislature, like Nebraska.) There are some good provisions, such as reducing pay and benefits of elected officials, and an independent redistricting body, as long as it was truly independent. But merely getting rid of the bums, whether by vote (the preferred route) or by term limits (which Michigan has, and which some commentators believe are part of the problem), won't change very much. Even though Michigan's elected officials are clearly overpaid, it's not who they are or how many there are, it's what they are or are not doing. An economy in recession, which Michigan obviously is, needs tax increases like flooded land needs a rainstorm. (The simile of 2008.)

As Mackinac Center president Lawrence Reed puts it, "Ask any resident what ails Michigan, and 'we have too many judges and legislators' probably wouldn't make anybody's top-50 list. Few people are foolish enough to think that simply reducing those numbers would transform Michigan. Most people would say our taxes need cutting, the bureaucracy needs trimming, the schools need mending, the business climate needs improving, or Detroit needs reforming. But RMGN does none of that, which makes it a huge distraction from fixing the state's fundamentals."

Reform is not about replacing one politician with another, or not replacing one politician; it's about replacing bad policies with good policies. That's the case in Michigan and in Wisconsin.

July 25, 2008

The former pride of Kenosha

Hot Rod magazine, a publication for car enthusiasts, committed one of the great April Fool’s jokes in the history of magazine publishing when it breathlessly reported in its April issue that a group of private investors were working to bring back the late American Motors Corp. (The disclaimer at the beginning of the Web page didn’t appear until the last paragraph of the printed version.)

Hot Rod magazine, a publication for car enthusiasts, committed one of the great April Fool’s jokes in the history of magazine publishing when it breathlessly reported in its April issue that a group of private investors were working to bring back the late American Motors Corp. (The disclaimer at the beginning of the Web page didn’t appear until the last paragraph of the printed version.)As with any successful practical joke, this one worked because

of the appearance of plausibility. Given that the 2008 Ford Mustang looks like the 1967–68 Mustang, and given that Chrysler is resurrecting the Dodge Challenger and General Motors Corp. is bringing back the Chevrolet Camaro, is it possible that someone might want to resurrect the AMC Pacer (top photo) or, even better, the Javelin (right photo)?

of the appearance of plausibility. Given that the 2008 Ford Mustang looks like the 1967–68 Mustang, and given that Chrysler is resurrecting the Dodge Challenger and General Motors Corp. is bringing back the Chevrolet Camaro, is it possible that someone might want to resurrect the AMC Pacer (top photo) or, even better, the Javelin (right photo)?AMC, created by the merger of the former Nash and Hudson brands, was the smallest member of the Big Four automakers, until Chrysler purchased it in 1987 to get the Jeep brand into the Chrysler fold. AMC first had a reputation for building compact cars

, such as the Rambler, in an era in which compact cars were only sporadically popular. One of AMC’s presidents was Gerald Romney, a later governor of Michigan and Republican presidential candidate, and father of 2008 presidential candidate Mitt Romney.

, such as the Rambler, in an era in which compact cars were only sporadically popular. One of AMC’s presidents was Gerald Romney, a later governor of Michigan and Republican presidential candidate, and father of 2008 presidential candidate Mitt Romney.Having much less capital than its bigger three competitors, AMC nonetheless built some cars that were ahead of their time, thanks in large part to the work of chief stylist Richard Teague.

The company first took its sporty Javelin, chopped off the rear end, and created the two-seat AMX, a cult car among collectors today. A couple years later, AMC took its compact Hornet, similarly sliced off the rear end, and created the subcompact Gremlin (an unfortunate name for anything motorized), a car you could buy with a Levi’s interior. Whoever thought of adding four-wheel-drive to the compact Concord (born as the aforementioned Hornet 10 years earlier) created the Eagle (right photo), America’s first crossover sport utility (car with four-wheel-drive-truck-like capabilities), predating the Subaru Outback and other all-wheel-drive-equipped cars by 15 years. Then, in 1983, came the downsized Jeep Cherokee, the first compact sport utility. An AMC subsidiary, AM General, began work in the late 1970s on something the U.S. Army called the “High Mobility Multipurpose Wheeled Vehicle” — which, two owners and a marketing agreement with General Motors later, the world came to know as the Hummer.

The company first took its sporty Javelin, chopped off the rear end, and created the two-seat AMX, a cult car among collectors today. A couple years later, AMC took its compact Hornet, similarly sliced off the rear end, and created the subcompact Gremlin (an unfortunate name for anything motorized), a car you could buy with a Levi’s interior. Whoever thought of adding four-wheel-drive to the compact Concord (born as the aforementioned Hornet 10 years earlier) created the Eagle (right photo), America’s first crossover sport utility (car with four-wheel-drive-truck-like capabilities), predating the Subaru Outback and other all-wheel-drive-equipped cars by 15 years. Then, in 1983, came the downsized Jeep Cherokee, the first compact sport utility. An AMC subsidiary, AM General, began work in the late 1970s on something the U.S. Army called the “High Mobility Multipurpose Wheeled Vehicle” — which, two owners and a marketing agreement with General Motors later, the world came to know as the Hummer.Other AMC cars were not great cars, but at least they stood out on the street,

such as the Marlin (which arguably looked better as the Tarpon show car, based on a smaller model than the Marlin ended up being), the Gremlin, and the final two-door (right photo) and four-door versions of the Matador. Like the Pacer, the Matador coupe was in a class of one, while the last four-door Matador was referred to as “coffin-nose.”

such as the Marlin (which arguably looked better as the Tarpon show car, based on a smaller model than the Marlin ended up being), the Gremlin, and the final two-door (right photo) and four-door versions of the Matador. Like the Pacer, the Matador coupe was in a class of one, while the last four-door Matador was referred to as “coffin-nose.”One unusual AMC niche was in police cars. Anyone who watched “Adam-12,” “The Rockford Files” or “The Dukes of Hazzard” (I plead guilty to all three — any series with cool cars got my attention) might remember that those series all featured Matador police cars.

Many law enforcement agencies used Matadors because they probably were less expensive than their Big Three competition. (I once saw a sign in a National Guard armory that reminded everyone that all of their equipment was produced by the lowest bidder.) I don’t remember seeing Matador police cars in Wisconsin, but for several years in the early ’70s the Wisconsin State Patrol used Ambassador squad cars (this photo). So did a few sheriff’s departments, including Dane County, at least until a well-publicized spat between either AMC or the Madison AMC dealer and the sheriff over sheriff’s deputies’ habit of crashing said Ambassadors. (The dealership, from which we purchased a 1973 Javelin (read further), is still in business today, though it sells used cars now.)

Many law enforcement agencies used Matadors because they probably were less expensive than their Big Three competition. (I once saw a sign in a National Guard armory that reminded everyone that all of their equipment was produced by the lowest bidder.) I don’t remember seeing Matador police cars in Wisconsin, but for several years in the early ’70s the Wisconsin State Patrol used Ambassador squad cars (this photo). So did a few sheriff’s departments, including Dane County, at least until a well-publicized spat between either AMC or the Madison AMC dealer and the sheriff over sheriff’s deputies’ habit of crashing said Ambassadors. (The dealership, from which we purchased a 1973 Javelin (read further), is still in business today, though it sells used cars now.)There are conflicting schools of thought as to why AMC finally folded with its purchase by Chrysler. Patrick Foster, author of American Motors: The Last Independent, argues that AMC did fairly well in the 1960s, offering economical (for the day), sturdily built, stolid cars (similar to Mercedes-Benz in the day), until AMC management decided it needed to offer what the other members of the Big Four were offering — sporty cars (although the Javelin was quite successful in the Trans Am series) and big cars, products where AMC lacked the ability to compete with GM, Ford and Chrysler.

I maintain that the reason AMC doesn’t exist today as an independent manufacturer has to do with a decision the company made during the early 1970s to discontinue building its Javelin

“pony car.” Chevrolet built many more Camaros and Ford built many more Mustangs than AMC built Javelins, but the Javelin and its AMX two-seat cousin developed a reputation as race cars whose performance exceeded their reputation. (My first car was my father’s brown 1973 Javelin, a cool-looking car from the front seats forward, with a back seat suitable only for dolls.) The last year of the Javelin was 1974, just before the pony car market exploded and General Motors sold as many Camaros and Pontiac Firebirds as they could build.

“pony car.” Chevrolet built many more Camaros and Ford built many more Mustangs than AMC built Javelins, but the Javelin and its AMX two-seat cousin developed a reputation as race cars whose performance exceeded their reputation. (My first car was my father’s brown 1973 Javelin, a cool-looking car from the front seats forward, with a back seat suitable only for dolls.) The last year of the Javelin was 1974, just before the pony car market exploded and General Motors sold as many Camaros and Pontiac Firebirds as they could build.Instead of the Javelin (and the luxury Ambassador, killed at the same time),

AMC built the Pacer (right photo), a car that was small in length, but wider and thus roomier (or so AMC wanted the consumer to believe) than the average small car. It was, however, heavy for its length due to big windows and slow yet fuel-inefficient even for that time, and, as the New York Times put it, it “looked like nothing else on the road,” a plus perhaps only in the minds of Wayne and Garth.

AMC built the Pacer (right photo), a car that was small in length, but wider and thus roomier (or so AMC wanted the consumer to believe) than the average small car. It was, however, heavy for its length due to big windows and slow yet fuel-inefficient even for that time, and, as the New York Times put it, it “looked like nothing else on the road,” a plus perhaps only in the minds of Wayne and Garth.With AMC lacking money, 25 percent of AMC was sold to Renault (leading to the AMC Alliance and Fuego) before Chrysler purchased all of AMC in 1987. Chrysler closed the Kenosha manufacturing plant, originally built by Nash in 1902, in 1988. Chrysler’s Kenosha engine plant and General Motors’ Janesville plant are the only plants building cars in Wisconsin today, and the Janesville plant will be closing within the next two years. (My family must be a curse upon carmakers, since our family’s garage simultaneously housed a Kenosha-built Javelin and a Janesville-built Chevrolet Caprice. My parents also owned two of the last Oldsmobiles, and my father owned a Studebaker Hawk many years ago. Someone should warn Cadillac, Subaru and Honda of this.)

Given how things for the remaining Big Three automakers today, it’s hard to imagine how AMC could have made it to today had the sale to Chrysler not occurred. It is fun to contemplate, though, what could have happened had the “group of like-minded venture capitalists pooling billions of dollars to create the ultimate U.S. car company, and without the hindrance that comes with being a public company” been more than the figment of a creative writer’s imagination.

July 24, 2008

Hello muddah ... hello faddah ...*

First, I did pass the 100-yard swim test, for the second consecutive year. The fact that (1) I last swam 100 yards one year ago, as opposed to 25 years ago, helped, as did the fact that the water on Cedar Lake was at least 10 degrees warmer than last year. Second: There is no graceful way to get into or out of the top bunk of a bunk bed.

Our Ripon group bunked with a hilarious group from Neenah. (Think of Saturday Night Live's Da Superfans, some of whom are readers of Marketplace.) One of them concluded that the entire camp is a subterfuge — it's not a Cub Scout camp, it's Fat Farm for Dads, with 100-yard swims, paddleboating all over Cedar Lake, the climb up from the waterfront, etc. (I spoke to one of the wives of our group; she feigned ignorance.)

Based on this past week, I predict that within the next 20 years, there will be reports of an epidemic of genetic damage caused from large-scale use of bug sprays dating back to 2008 in Wisconsin. I went through almost an entire bottle of bug spray in less than three days. (Fortunately, my hair stylist, whom I saw Thursday, found no bugs, ticks, flies or other critters that don't belong in my hair.)

There was one moment that I found more profound than the rest of this appears. In conversation with a staffer (all the Camp Rokilio staffers are high school and college students, male and female), I mentioned that I was the bugler for my Boy Scout troop. I was about to mention that I was the least popular Scout in my troop when I blew "Reveille" every morning and "Taps" every night, when he interrupted, "You played the bugle? Can you still play?" When I said I did on occasion (actually, the trumpet, not the bugle), he asked if I would play "To the Colors" at the flag raising the following morning. He then got the camp's bugle, which I believe is older than I am, and appeared to have had previous close encounters with something larger and harder than the bugle, while having had no encounters at all with any kind of anti-tarnishing substance.

Having thus put myself on the hook, I practiced a few times Wednesday morning in the woods, hoping to reach the junction between practicing enough to remember the tune but not practicing too much to destroy my nonexistent chops. I got most of the notes, and, remembering my University of Wisconsin Band mantra that if you're going to fail, fail boldly, played sufficiently loud to scatter wildlife for at least five miles in every direction. (I play trumpet something like an old-style heating system: on — that is, really loud — or off.)

Afterward, I walked back to the Train Station group of Scouts, getting ... a round of applause. (It probably was applause for the fact that they didn't have to hear any more of my playing.) I also had several fathers, and many staffers, come up and thank me for playing. I had a couple staffers ask if I'd stay for the rest of the summer to play. (Let's see about that commute: Leave Ripon in the morning, get to Rokilio by 7:45, play, go to work, return to Rokilio by 5:45 to play, go home ...)

I didn't do this, and I'm not writing about this, to cover myself in glory, since my playing would have mortified the bugler version of me 30 years ago. (Note to self: Practice before next year.) I did it out of respect — respect for my country, respect for the Boy Scouts of America, and respect for Rokilio staffers who put up with a lot in dealing with seven- through nine-year-old boys for an entire summer. Something else came to mind too — you may have read that veterans groups and the military are having problems finding buglers to play "Taps" at veterans' funerals, some going so far as to play digital or otherwise recorded versions of "Taps." That's just wrong, although understandable given that there are, by one estimate, 500 buglers in the military, and 1,800 veterans who die every day. (Fortunately, a group is recruiting volunteer bugle players.)

One should show respect when one has the opportunity.

* If you don't know what this refers to, you must broaden your cultural education. Or click here.

Your 8 cents (per gallon) worth

Eight cents per gallon isn’t much. But $990 million is, and that’s what WPRI estimates the minimum markup law costs Wisconsin residents in gasoline prices — up to $278 million more than we would pay without the law. Since the minimum markup of either 6 percent on the wholesale price or 9.18 percent of the posted terminal price is a percentage, rather than a flat cents-per-gallon fee (as is the case with the 32.9-cent-per-gallon gasoline tax), the higher wholesale gas prices go, the higher the minimum markup is. (For example: In January 1998, when the wholesale gas price was 64 cents per gallon, the minimum markup was 5.9 cents per gallon. Earlier this month, when the wholesale price was $3.29 per gallon, the minimum markup was 30.2 cents.)

The rationale for the minimum markup law, to prevent predatory pricing by larger oil companies, doesn’t hold water, so to speak. The WPRI study cites 2003 research by the Federal Trade Commission:

“Economic studies, legal studies, and court decisions indicate that below-cost pricing that leads to monopoly occurs infrequently. Below-cost sales of motor fuel that lead to monopoly are especially unlikely. For these reasons, we believe Wisconsin’s Unfair Sales Act likely harms consumers and restricts competition. Moreover, at best, the Act is unnecessary because the federal antitrust laws already protect against predatory pricing.”That rationale applies only if you believe that government should be in the business of telling businesses what to charge for their products. To believe this rationale requires belief in conspiracy capitalism, that these big evil (insert kind of company here) corporations are conspiring to squash their small competitors like a bug so they can stick it to the consumer and charge whatever they want. Note the line from the Federal Trade Commission: “Below-cost sales of motor fuel that lead to monopoly are especially unlikely.”

Service station owners will tell you that they don’t make much profit, even with the minimum markup law, on gasoline. The Journal Sentinel quotes Matt Hauser, president of the Wisconsin Petroleum Marketers and Convenience Store Association, as saying that service station owners are “lucky” to get 2 to 3 cents per gallon in profit.

I’m certain that Hauser is correct. I am also certain that that’s not the problem of consumers, including businesses whose livelihood depends on transporting products by land and are now charging more and/or enjoying less profit as a result of higher gas prices. It is also not an issue the government should be deciding, whether it’s gas prices, food prices (which also were subject to the minimum markup law before the 1980s) or the prices of anything else. If Megalomart decides to set its gas prices at whatever their costs are, so what? Is the next government step, as the Wisconsin State Journal wrote in 2001, “more laws to protect Joe’s Hamburger Stand from lower hamburger prices at McDonald’s, or to shield Ann’s Hardware Store from cheaper tool prices at Wal-Mart”?

WPRI calls the minimum markup law “one of the most overt examples of select businesses reaping the benefits of government-mandated profits at the expense of the consumer. …Aside from the additional cost of fuel to the consumer, high gas prices seep into the price of all goods and services transported throughout the state. When it costs more to truck candy bars to a grocery store, that price will be reflected in the cost of those candy bars. As a result, Wisconsin consumers end up not only paying higher prices at the pump, but they end up paying ancillary costs hidden within goods and services they need.”

Government interferes enough in the free market as it is without also telling companies what they must charge for gasoline, tobacco and alcohol, or to try to pick winners and losers (small = good, big = bad). The Minimum Markup Law, like a lot of legislation passed during the Great Depression, was a bad idea then and is an outmoded law now.

Taxes, businesses, taxes, government and taxes

Campaigns started earlier in Wisconsin because we have a primary election shortly after Labor Day. But thanks to the 24/7 news cycle and the Internet, any campaign can start as soon as the filing deadline.

Jo Egelhoff, former Appleton alderman who is running for the 57th Assembly District seat being vacated by Rep. Steve Wieckert (R–Appleton), talked in The Post~Crescent about what the state needs to do to attract more jobs, essentially: “1) reducing our horrific budget deficit and 2) creating a positive tax climate for employers and employees alike.”

Egelhoff pointed out, correctly, that the fact that Wisconsin has slipped out of the top 10 taxed states list is not because of any focus on governmental economy in Madison, but because some states raised their taxes beyond Wisconsin’s, and others have collected more tax revenues because of oil price increases. Egelhoff favors creating a small business tax credit program “to encourage risk-taking and growth” for companies in their first two years of operation.

Reading the online responses to Egelhoff’s commentary proves that there is a great deal of misunderstanding about how business and taxes work among the electorate. Cutting “wasteful spending” is assumed to mean “spending towards helping people, and not corporations.” At least one person does grasp what we all know, that “consumers should understand that taxes to corporations are simply added to their product price and we reimburse them at the cash register.” (The complete answer, of course, is that every dollar a business is taxed is a dollar that won’t go to the business’ owners or to the business’ employees or back into the business.)

There was a longer assertion about how Egelhoff “utterly fails to see the connection between education and taxes. Folks, if we want to have a first-rate educational system, we have to pay for it. … We don't want to cut their funding because they produce the educated workforce that Ms. Egelhoff touts in her article. In fact, we need to increase their funding just to keep up with inflation. If we make low taxes an important part of our program to attract business, we will join a race to the bottom. We will cut and cut and cut our public services until we become just another Third World country, and we will still fail because, on that basis, we cannot compete with China, Brazil or Thailand.”

“Race to the bottom” is a favorite phrase of those who believe we don’t spend enough money on government now, and, by extension, that we are insufficiently taxed. My first suggestion is that those people who really believe we should be taxed higher should in fact send more money to the government.

But what exactly is enough in taxes and spending? Wisconsin is in the top fourth of states in education spending and, at $6,157 per student, we spend 5 percent more per student than the next-highest-spending state in the Midwest, Minnesota, and 8½ percent more than the national average. In this past school year, per-pupil spending increased 4.2 percent, and total school costs increased 3 percent, according to the Wisconsin Taxpayers Alliance. This is, incidentally, despite the fact that enrollment has dropped in Wisconsin for the past four consecutive school years. (Perhaps the fact that teacher and administrator employee benefits are 52.5 percent more than the national average has something to do with it.)

Moreover (and, as a reminder, none of this necessarily represents or reflects Egelhoff’s positions) is our educational system really first-rate? When teachers are paid according to years of experience and educational level instead of quality, the answer is clearly no. When the only way to get rid of a teacher is either for that teacher to commit gross misconduct, or for the school district to engage in job-cut maneuvering or wait out that teacher’s retirement, none of those are signs of a first-rate educational system. When the only way to reward a teacher for superior performance is to raise the pay of all teachers of similar experience and educational level — that is, when individual teachers are not able to negotiate their own salaries — that is not a sign of a first-rate educational system either.

(For those who think the previous paragraph is an exercise in teacher-bashing, it is not, but consider: Reality says that 75 to 80 percent of school district budgets are for personnel costs. Reality also says that schools are the largest part of your property tax bill. Do the math.)

The assertion a few paragraphs ago refers to the importance of our “educated workforce.” The importance of an educated population, not just workforce, is self-evident. However, note the CNBC.com survey of state business climates I wrote about earlier this month, which (A) places Wisconsin at 37th overall, (B) ranks Wisconsin 47th in “workforce” (defined as the numbers of available workers and their average education level, unionization level, and the job placement success rates of state worker training programs), and (C) ranks education as fourth most important for businesses, with “cost of doing business” number one.

Profitable businesses (1) provide their customers with useful products and services, (2) pay employees and (3) pay their owners. Many businesses also make contributions out of their profits, at the discretion of management, to their communities that go beyond those three points. That is how “private enterprise” contributes to the “public welfare.” (And besides that, every corporate employee who earns a salary, including that high-paid management, pays taxes anyway. Corporate income taxation is really triple taxation — employees pay taxes on their income, shareholders pay taxes on their dividends and their capital gains, and the corporation pays income taxes — except that the corporate tax is hidden in the prices of products and services.)

If corporate taxes were reduced to zero, there would be no need for Egelhoff’s proposed small business tax credit, or any other business-oriented tax credits, and no lobbying legislators for tax breaks. There would also be no need for the accountants larger businesses use to avoid taxes. (Appropriately, I might add; a corporation's fiduciary responsibility to its shareholders is to maximize profits, and taxes eat profits.) Corporate revenues and profits would then go to the proper places, which, once again, are (1) the business, (2) employee pay, and (3) shareholders.

Based on how too many people in Wisconsin vote, there is one place schools seem to be particularly deficient — economic education.

July 23, 2008

Analysis of the Day

With less than four months to the election, many businesspeople are undecided. A recent poll of small-business owners found that 80% had little idea what either candidate might do for them. Dave Bromberg, a grocer in Albuquerque, says he likes both of them. He thinks Mr McCain is tough on waste but Mr Obama would have trouble standing up to a free-spending Democratic Congress. “Democrats feel sorry for everybody,” he says. “McCain will probably say, hey, we’re all responsible for ourselves, and [the government] will help you a little bit, but only a little.”

July 22, 2008

“Global” warming?

But go back to the first half of that last sentence. What if global warming isn’t occurring at all?

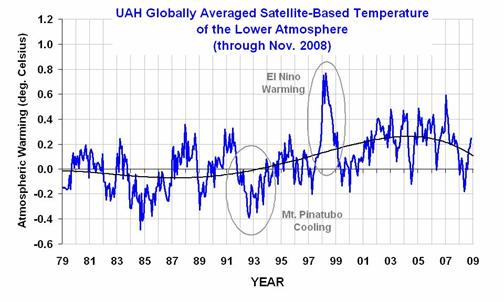

GlobalWarming.org first notes that the average temper

ature in 1979 and the average temperature in June 2008 is the same. This graph shows that temperatures have generally ranged from 0.5 degrees cooler than normal to 0.6 degrees warmer than normal in the past 19 years, with notable cooling around the eruption of the Mount Pinatubo volcano in late 1992 and notable warming during an El Niño event in ear

ature in 1979 and the average temperature in June 2008 is the same. This graph shows that temperatures have generally ranged from 0.5 degrees cooler than normal to 0.6 degrees warmer than normal in the past 19 years, with notable cooling around the eruption of the Mount Pinatubo volcano in late 1992 and notable warming during an El Niño event in ear ly 1998.

ly 1998.The next map, from NASA,

shows the change in surface temperatures in 2007 and 2008 compared with average surface temperatures between 1995 and 2000. The blues on the map show cooling, and the yellows and oranges show warming.

shows the change in surface temperatures in 2007 and 2008 compared with average surface temperatures between 1995 and 2000. The blues on the map show cooling, and the yellows and oranges show warming.Note that the northern U.S. and Canada have cooled, while the southern U.S. is warmer. Note also that the northern and central Atlantic Ocean and northern and southeastern Pacific Ocean have cooled, but the rest of the Pacific, along with the Indian Ocean have cooled.

Not convinced? OK, let’s compare 2000 to 2008

against 1900 to 2000.

against 1900 to 2000. Note that the U.S. from the Plains east has warmed some, but not from the Plains west. The southern half of South America and northern Europe have cooled, while the southwestern half of Europe and eastern Asia have warmed. The Arctic has warmed, while the Antarctic has both warmed and cooled. The Atlantic and southeastern Pacific oceans have warmed, but not the western Pacific. (Click here to comparisons of your own using a variety of variables.)

Note that the U.S. from the Plains east has warmed some, but not from the Plains west. The southern half of South America and northern Europe have cooled, while the southwestern half of Europe and eastern Asia have warmed. The Arctic has warmed, while the Antarctic has both warmed and cooled. The Atlantic and southeastern Pacific oceans have warmed, but not the western Pacific. (Click here to comparisons of your own using a variety of variables.)This isn’t proof of global warming. It may be proof of warming within regions of the globe, but it may also be proof of cooling within other regions of the globe. That suggests that solutions to global warming are solutions to what is not a global problem, and may actually have negative effects in some parts of the planet. (Free market solutions are better anyway.)

It’s interesting to note that the global warming true believers not only entertain no doubt about their belief in global warming, but they actively attack the more skeptical. Heidi Cullen, host of “Forecast Earth” on The Weather Channel, has gone so far as to advocate that meteorologists who dare question global warming have their American Meteorological Society certifications revoked. Apparently science is no longer interested in testing theories.

July 21, 2008

Be(ing) Prepared

For the first part of this week, I won’t be in the office. I’ll be at the Boy Scouts of America Bay–Lakes Council’s Camp Rokilio, a Cub Scout camp, with my oldest son and the members of Cub Scout Pack 3735 of Ripon, away from cellphones, the Internet, email and my car.

This is the second consecutive year we’ve done this. Michael said last year he wanted to come back to Rokilio before we left Rokilio one year ago, so we were the first to sign up this year. Camp Rokilio, near Kiel, is something else, with six theme buildings — a fort, a gold mining village, a Viking ship (given my Norwegian heritage, I should lobby for this one), a space station (where we stayed last year), a castle, and a train station (where we’re staying this year). Assuming I survive the 100-yard swimming test (it nearly killed me last year — probably due to the effects of one of my damnable sinus infections and the fact I hadn’t swum 100 yards in approximately 25 years — even though I passed), there will be swimming, attempts to drown each other in paddleboats, archery and BB gun shooting, activities tied to, in our case, trains, and father-and-son time in the outdoors, rain, humidity and mosquitoes or not. That also includes my being the master of ceremonies for the Tuesday night campfire one night before departure, which is not an easy task. (You try coming up with jokes that entertain eight-year-olds and their fathers.)

This is all sort of a flashback for me, even though Cub Scout camps didn’t exist in my Cub Scout days. I moved on from Cub Scouts to Boy Scout Troop 67 in

One of the larger honors I’ve received was to speak at the Eagle Scout ceremony of a member of my church. The ceremony occurred 25 years after I got my Eagle Scout award, and, in a great example of calendar circumstance, 30 years to the day I left for my first full-fledged overnight campout, at the Kettle Moraine State Forest Northern Unit near

As I told the Scouts two years ago, that first campout was something I survived, rather than enjoyed. Being in August, it was hot and humid, and hiking with a fully packed pack is hard work. I was homesick despite the fact I had been away from home before then and my time away from home for the campout totaled less than 48 hours. I was thoroughly intimidated by the entire experience, and I didn’t fit in since I was a new Scout. My father picked me up, and I had planned to tell him that I’d had a terrible time and wanted to quit. What prevented that was another Scout, someone I didn’t even know, who needed a ride back to

Perseverance isn’t one of the Scout laws (they are, and I’m typing this without consulting the Internet: A Scout is: Trustworthy, Loyal, Helpful, Friendly, Courteous, Kind, Obedient, Cheerful, Thrifty, Brave, Clean and Reverent), but perhaps it should be, since, as adults find out, much of life is simply sticking it out. Perseverance is also a key to getting an Eagle Scout Award, since, when you’re 10 or 11 years old as a new Scout, that Eagle Scout Award is a long way off. As with any major accomplishment — say, getting an MBA degree, or winning the Super Bowl, or, as I did while I was in Scouting, hiking in the Rocky Mountains at the Philmont Scout Ranch in New Mexico — the accomplishment really isn’t about achieving the accomplishment, but in doing what it takes to earn that accomplishment.

(And speaking of accomplishment, a design accomplishment occurred with whoever designed my backpack. My parents bought it for me in the spring of 1976, and it went on every campout of mine in Boy Scout days, including the aforementioned New Mexico trip. I'm using that same backpack this week, 32 years after I got it.)

Boy Scouts are usually middle-school boys. That is a group that desperately needs role models, regardless of the kind of home they come from. I certainly didn’t come from a bad home — my parents have been married for 47 years, and other than sibling rivalry, there were no pathologies at home — and yet Scouting was important for me because Scout leaders, most of whom were the fathers of other Scouts, showed me that what my parents were talking about — do your work and do it well, be trustworthy, go to church, and so on — wasn’t just something my parents cooked up to make my life difficult; they lived the lives mature adults should live. That is a message that can’t be repeated enough not just to Scouts, but to middle and high school students, boys or girls.

Scouting seems to have become less popular over the years, although it wasn’t necessarily popular, at least among my age group. Scouting, of course, teaches values that are timeless, even if those values aren’t trendy or “in.” It’s not cool to be a Scout, and it’s not cool to live your life as a Scout; it’s just the right thing to do. Society, including business, should be encouraging organizations that encourage being trustworthy, loyal, helpful, friendly, courteous, kind, obedient, cheerful, thrifty, brave, clean and reverent. (That’s all I’ll say about the question of whether United Way funding should extend to the Boy Scouts, who refuse to allow homosexual men to be leaders.) I can’t think of a business that wouldn’t welcome an employee who lived his or her life according to those 12 tenets. This country doesn’t need more celebrities; it needs more people who try to live their lives according to those 12 parts of the Scout Law.

I told the Scouts — and who knows if the words connected — that the fact I was able to recite the Scout Law and most of the Scout Oath that day probably demonstrates that my Scouting experience did have an impact on me that extends to today, even if I don’t consciously asked myself every morning what good turn I’m going to do that day. I think the Scout Oath, which begins "On my honor I promise to do my best," and the Scout Law are a pathway to becoming someone who puts more into society than he takes out, regardless of how famous or wealthy or powerful someone is or is not, wherever someone is and whatever someone does.

July 18, 2008

Analysis of the Day

[Roosevelt’s] formula was like Disraeli’s: political innovation to restore traditional national morality. He had an image of an American hero — thrifty, hard-working, vigorous and righteous — and sought to create a Square Deal for that sort of person. “The true function of the state as it interferes in social life,” Roosevelt wrote, “should be to make the chances of competition more even, not to abolish them.”

John McCain’s challenge is to recreate this model. He will never get as many cheers in Germany as Barack Obama, but for a century his family has embodied American heroism. He will never seem as young and forward-leaning as his opponent, but he did have his values formed in an age that people now look back to with respect.

The high point of his campaign, so far, has been his energy policy, which is comprehensive and bold, but does not try to turn us into a nation of bicyclists. It does not view America’s energy-intense economy as a sign of sinfulness.

If McCain is going to win this election, it will because he can communicate an essential truth — that people in a great and successful nation do not want change for its own sake. But they do realize that it’s only through careful reform that they can preserve what they and their ancestors have so laboriously built.

Down on the farm

There’s something ironic about a farming and agribusiness expo being shortened because of something farmers deal with all the time — bad weather.

It’s a good thing I went to Farm Technology Days in southeastern Brown County Tuesday. Wednesday afternoon, the expo grounds were evacuated because of severe weather moving into the area, and the severe weather left more than two inches of rain, forcing the expo’s last day to be canceled.

Farm Technology Days is an interesting look into all the iterations of agriculture and agribusiness throughout the state. The list of exhibitors in an entire city of tents ran from A (A–A Exhibitors) to Z (Ziegler Ag Equipment). Farm equipment I don't recognize (my wife, the farmer's daughter, could have, but she wasn't there) mingled with everything from small lawn tractors to giant all-wheel-drive articulated tractors as tall as my house, along with pickup trucks, medium- and heavy-duty trucks, tractor–trailers, and even enormous semi-based recreational vehicles. I didn't get to participate in the various demonstrator opportunities, for driving tractors, lawn equipment, skid steer loaders, and so on. (I was wondering how I could get a John Deere representative to bring the high-feature lawn tractors to my house, which needs mowing.)

Your tax dollars were represented too. Five different agencies of the U.S. Department of Agriculture were there. Twelve representatives of the University of Wisconsin System were present. The state Department of Agriculture, Trade and Consumer Protection, and the Department of Natural Resources, and the Division of Public Health were all there too.

I've gone to two Farm Technology Days back when it was called Farm Progress Days. My grandfather, who sold farm implements (he had the previously mentioned station wagons stuffed to the roof with farm equipment catalogs), probably attended almost all of them from when the expo began in the 1950s until around his death in 1994. I've become more interested in agriculture over the years for two reasons — first chronologically, because I started working at a small-town newspaper out of college, so I got an education into farming, and even the byzantine way that milk prices are set. Then, I married into a farm family, so I got an even better education in farming from my late father-in-law and my brother-in-law.

(After living in rural areas for a few years, I was able to distinguish between the different sources of manure as I drove past a farm. Cow is the most common, but there are other sources; the worst is slurry, which comes out of the ironically named "honey wagon" after fermenting in tanks for the appropriate amount of time. My father-in-law called that, seemingly pungent enough to asphyxiate birds flying in the air, "the smell of money.")

Farms are where Wisconsin's vaunted work ethic began. Farming is an every-day activity, with no days off unless you can arrange for someone to do the daily work. (Dairy cows will react badly to your leaving them at 5 Friday afternoon and returning at 8 Monday morning expecting them to deliver milk immediately.) The former owner of the former fire truck builder 3-D Manufacturing in Shawano once told me he loved to hire farmers for his plant because they all worked hard and were mechanically inclined, because they had to be.

Farming is also about as tough a business as there is. You may notice that there are a lot of bare (and, if the weather forecasts for the weekend are to be believed, about-to-be-inundated) spots in farm fields this wet summer. Those non-planted areas generate expense, but no income. Think of this conundrum: If a farmer has a bad year for crops, the farmer gets little money. If a farmer has a good year for crops, the farmer may get little money if everyone else also has a good year for crops. It must be a bit unnerving for a farmer to borrow money to be able to plant crops and then hope he has enough money from selling crops to pay off the season-opening loan.

Farm products are an economic area where Wisconsin shines, and generally without the subsidies farmers in other areas of the country receive. (Farm subsidies, by the way, lead to what the federal government considers "excess capacity," leading to the government's paying farmers not to grow. The way to eliminate the "excess capacity" is to eliminate the subsidies, according to the Cato Institute's James Bovard.) Wisconsin doesn't just export food, but food processing machinery as well. This is why everyone in Wisconsin should favor free trade, because it benefits Wisconsin.

Farm Technology Days is, if nothing else, a reminder of how important agriculture is to

The converse of the farming-ignorant is those who believe that farms are so sacred that they want nothing non-farm-related done to them. This poses problems given that many people in this state now live in, or on, what formerly was a farm field of some sort, the result of population growth and the reality that more food production can take place on less farmland today. The fact is that, bucolic as they may look, farms are factories, where production of crops and cattle take place. They may be more picturesque than your typical smokestack-equipped factory, but they are places of manufacturing, not something that exists for your pleasant view.

Think about that the next time you drive past a farm ... or try to decide on a beverage with your lunch.

July 17, 2008

My favorite fundraiser

And well you should. Saturday is my favorite fundraiser (perhaps I should say fundraiser), the BMW Ultimate Drive benefiting Susan Komen for the Cure, a breast cancer research foundation. The BMW Ultimate Drive has raised more than $11 million since it began in 1997.

For gearheads, this is too good to be true. Test-drive a BMW at Enterprise Motorcars in Appleton between noon and 5 p.m., and BMW makes a $1 donation for every mile of the test drive.

Women know why this is important. In 2007, according to the American Cancer Society, an estimated 240,000 new cases of breast cancer were diagnosed in the U.S. — the number one cancer among women — and about 40,000 women died of breast cancer. Only lung cancer is a bigger cause of cancer deaths among women.

For men, it shouldn't take too much time to figure out why this is important. Every male reader of Marketplace has or had a mother. Most have wives. Some have sisters. Some have daughters. Most have female coworkers or neighbors or friends.

I mentioned before that breast cancer was estimated to kill 40,000 U.S. women last year. But according to the National Cancer Institute, as of January 2004 2.4 million women with breast cancer were alive — they were either being treated for cancer or had reached the magic five-year mark after diagnosis.

I know one of those people. My mother was diagnosed with breast cancer 20 years ago. She had none of the major risk factors — she had no family history, she wasn't overweight, she didn't smoke, and she didn't drink heavily. (Interestingly, she was one of three women on the block of Madison where I grew up to get breast cancer.) Her case of breast cancer was advanced enough, with lymph node involvement, that she was given a 22-percent chance of surviving five years. The chemotherapy also made her too sick to finish the full course of chemotherapy.

Fortunately, she has survived to see her children graduate from college, her son get married, the birth of her grandchildren, and retirement. Also fortunately, treatment is more effective, with fewer side-effects, than it was even 20 years ago.

The Ultimate Drive is quite a bargain — drive cool cars, and raise money toward a cure for breast cancer. Click here to register.

Happy (?) Cost of Government Day

Today, nearly three months later, is Cost of Government Day, as noted by Americans for Tax Reform and by Citizens Against Government Waste — the day our earnings finally match federal, state and local government spending. The national-average Cost of Government Day was Wednesday, but, of course, because Wisconsin has more government spending than most states, our Cost of Government Day is a day later, today, 37th latest among the states.

(Number 37 … why does that sound familiar? … oh, yes. Our state also ranks 37th in business climate, according to CNBC.com. I wonder if they’re related.)

The first point to ponder: We pay one-third of our income in taxes, but government costs total more than half of our income. ATR terms “government costs” as not just government spending, but also costs tied to regulations (which cost $1.16 trillion in 2007, according to the Competitive Enterprise Institute, or an estimated 62.6 days of work, according to ATR). That is what a budget deficit looks like.

That deficit is not caused by insufficient taxation (ATR notes that the federal budget deficit dropped from 3.6 percent of Gross Domestic Product to 1.2 percent of GDP between 2004 and 2007); it’s caused by excess spending. ATR estimates that, had federal spending been tied to the rate of personal income growth, the deficit would have been entirely eliminated by 2006.

“This type of wasteful spending takes money away from real national priorities and contributes to the inefficiencies of government,” said Tom Schatz, president of Citizens Against Government Waste, whose 2008 Pig Book chronicles 11,610 porky projects — defined as “a line-item in an appropriations bill that designates tax dollars for a specific purpose in circumvention of established budgetary procedures — totaling $17.2 billion. Wisconsin’s contribution totals $174.8 million, 1.02 percent of the total, interesting given that Wisconsin has 1.83 percent of the U.S. population. Even in pork, we’re poorly represented in Washington. (The contributions of U.S. Reps. Steve Kagen (D–Appleton), $23.79 million, and Tom Petri (R–Fond du Lac), almost $13 million, can be found by searching here.)

Some readers may think this is either bad methodology (it’s the same methodology the Tax Foundation uses to compute Tax Freedom Day — divide total taxes or spending by total income) or that such rankings don’t really matter. It really does matter, if for only this reason — the fact that Wisconsin is losing high-income residents to states with lower tax burdens.

The source for this assertion is ATR’s study of people moving from state to state and the income they take with them. ATR claims that “Several empirical studies have documented the surge of taxpayers moving from high tax to low tax states over the past 15 years. Indeed, these studies show that taxes are the single largest factor in interstate migration, rather than such factors as weather, employment, family relocation, etc.”

ATR reports that between 1996 and 2006, the 10 highest taxed states lost 2.4 million residents and $69.51 billion in income from people leaving for states not part of that top 10 list. Conversely, the 10 lowest taxed states gained 1.4 million residents from other states not part of that bottom 10 list, with real income gain of $30.5 billion over that decade. Between 2004 and 2006, the nine states that don’t have an income tax gained more than 1 million residents from the other 41 states, bringing with them $37.3 billion in income, according to ATR and the Internal Revenue Service.

Part of this is one of the more unpleasant, but less noticed, changes in Wisconsin’s economy over the past 15 years — the departure of corporate headquarters from Wisconsin, which, you’ll recall, began with the well publicized move of Kimberly–Clark Corp.’s corporate offices from Wisconsin to Texas. (More on that in the near future.) People who work at corporate headquarters make higher-than-average incomes and thus pay higher-than-average income taxes. Corporations make location decisions based on not just business-related taxes, but on personal taxes as well.

ATR's answer is for the 41 states that have income taxes (beginning with Wisconsin, where the income tax began) to phase them out. (I'll pause while you pick your jaw up off the floor after contemplating this state without an income tax.) ATR proposes a combination of states' increasing their sales taxes by 2 or 2.5 percentage points (taking the sales tax up to 7 to 7.5 percent in Wisconsin, plus 0.5 percent in those (misguided) counties with sales taxes) combined with strict budget growth controls of either the increase in state income minus 1 percentage point or the sum of a state's population growth and inflation.

That previous paragraph is a conservative fantasy in this state, of course. Property, income and sales taxes have roughly equal portions of tax collections in this state. Eliminating one would force the state to increase rates so that collections of the other two increased by one-sixth each to make up the difference. Moreover, in an era of growing Internet sales, perhaps the sales tax is an outmoded way to collect tax revenue. Given that property taxes receive the most complaints from state taxpayers, tax changes to increase property taxes substantially would make that option, to say the least, unpalatable to most state legislators. And, as I've argued in this space before, actually cutting taxes and spending is contrary to our state's political culture, including that of the party that is supposed to be about cutting taxes and spending. (Which party was in power in the Legislature when the Taxpayer Bill of Rights referendum proposal died?)

Then again, cutting taxes and government spending seems increasingly a conservative fantasy. As I wrote on Tax Freedom Day, those who want to cut taxes and government spending in Wisconsin have to fight our ancestry and history, plus 2,292 units of government, plus organizations that believe that your taxes aren't high enough. On that cheery note, Happy Cost of Government Day.